Please note, I’m definitely not a CPA or CFP (understand, the person writing this post went to school for theatre who just nerds out on personal finance — check with your accountant to confirm what I’m sharing is right and let me know if it isn’t.)

Will the Trump Tax Plan Benefit the “Middle Class?”

Before we even discuss whether or not the tax plan will benefit anyone, it’s very important to note that all the cuts for people are set to expire in 2025. As this article poignantly notes: “enjoy your tax cuts while they last.” Any amount of savings you may be seeing in the coming years will go away without further action from Congress. Meanwhile, those tax cuts for businesses are permanent. Let that sink in for a minute.

Ok, so now that we got that out of the way (that we’re talking about benefits for the next seven years), let’s dive into if the changes benefit the middle class.

The Standard Deduction is Doubled!!! WOWWWWIE!!! Look, Shiny Squirrel!

Let’s snopes this one out for a minute. Here we get a true Trumpism — look, cute shiny squirrel over there, do not pay any attention to the lions eating your babies behind the curtain.

The standard deduction did increase in 2018 — it nearly doubled (or, in Trump speak, it doubled — bah, math) — from $6350 per person to $12,000 per person or $24,000 per married couple (it would be $25,400 if it actually doubled, but who’s counting.)

Either way, this sounds great. You get to “not pay” taxes on $11,300 more of income as a family, or $5650 as an individual. Any time we say “you get to not pay taxes” another important point is the richer you are, the more valuable this is due to the progressive tax system. To explain this simply:

Let’s say you are well off, in the top tax bracket, and paying 37% tax on $100,0000. You would be paying $37,000 in taxes on this. But, with the increased deduction, you’re only paying $32,819 in taxes on that income, a savings of $4181.

Now, let’s say you’re a middle income earner. This is not exactly right because tax brackets don’t cover $100,000 of income, but for the sake of simplicity, let’s say you make between $77k and $165k as a married couple and you are paying 22% tax on that $100k. That’s $22,000 in tax. But, with the increased deduction, you’re now only paying $19,514 in taxes, a savings of $2486.

This is not exactly right, but the point here is — and is very important to understanding why tax deductions are more valuable to people who are making more money and in higher tax brackets. In this case, the deduction is worth $1700 more for the upper class vs middle class person (about, the actual math which I’ll do one day and update here will shift a bit, but the lower-earning person or couple will still save less. That’s the nature of a progressive tax system.) So, you’ll notice, any change that’s “good” for the middle class is typically “a fuck ton better” for rich people.

*I have nothing against rich people. I live in a very high cost of living area and recognize that a $200k or even $300k income as a married couple does not = a life of leisure. Every situation is different, but for the sake of this article I’m considering middle class couples who earn, joint, between $77k and $165k. That’s not middle class where I live, but most of you don’t live where I live so on with the story…)

But isn’t the standard deduction doubling good for me??? DOUBLING SOUNDS GOOD. THAT’S LIKE, MORE THAN SINGLING.

Maybe. If you are single or a married couple without kids (I’ll come back to this in a bit — it’s very important) and you typically take no deductions outside of the standard deduction, then yes. One of the key marketing messages of the new tax plan is that this all “simplifies the tax code.”

Well, sort of.

It’s true that it can be a pain to itemize deductions — and at some point doing this in — choose your poison online tax software —and you have to invest in an accountant that costs more than $99.99.

The problem with increasing the standard deduction is that for people who do itemize it reduces the value of their itemization. This especially hurts non-profits that rely on donations from lower class/middle class supporters — those deductions are no longer itemized (unless you’re donating over $24k per couple per year, which isn’t happening for lower income or most middle income couples), so people may be less likely to donate(a tax deduction is not the only reason people donate money, but it certainly helps encourage it.)

Other than charity, though, the doubling of the standard deduction means that people who deduct higher cost items like a mortgage or medical costs for chronic illness are going to lose out. This article explains the whole situation better than I can. Yes, they get to just double their standard deduction, which theoretically covers this anyway… but they also lose (cue dunh, dunh, dunh suspense music…)

The Loss of the Personal Expemption

Wait, what? You’re losing a deduction? How come that wasn’t in the promotional materials on this tax plan?

The personal exemption is GONE from the 2018 tax plan.

WTF is a “personal exemption?”

Well, much like the standard deduction is a certain amount of money you don’t have to pay taxes on, the personal exemption adds to this amount. Upper middle class / rich people didn’t like this because there is a phase out for taking the personal exemption (there isn’t a phase out for the standard deduction, by the way.) As a married couple, in 2017, if you made more than $436,300 (or $313.8k as a single person because of the marriage penalty, more on that later), you wouldn’t be allowed to take a personal exemption (and it started to phase out at $313.8k for married couples filing jointly — which is middle class in the Bay Area but upper middle class in most everywhere else.)

What’s important about the Personal Exemption, other than that it was designed to be a benefit for lower class and middle class people, is that you would take it for every kid in the household.

So, a family of 3 would have a $12,150 exemption. A family of 4, a $16.2k deduction, and so on.

With removing this, the quick math of the “doubling” of the standard deduction minus the removal of the personal exemption plays out as such:

$6050 per person x 2 adults +$16.2k exemption for family of 4 = $28.3k not being taxed.

Wait a minute… so you’re saying with the doubling of the standard deduction and removal of the personal exemption, as a family of 4, I’m paying taxes on $4.3k more in income in 2018?

WHAT ABOUT THE CHILD TAX CREDIT???

About the Child Tax Credit

There’s some relief for the math above. The child tax credit per qualifying child is worth $2000. So, simply, it’s no longer worth $4050 per child. It’s now worth $2000 per child (I’ll save you a click to the calculator, that’s $2050 less a kid.) For very low income people, much thanks to the work of Marco Rubio, the refundable portion of this tax credit is $1400 (meaning, even if you don’t make enough to have any money to tax, you still get $1400 back per kid.) But, on the other end of the spectrum, you can make a lot more than previous to qualify for this deduction on your kids.

Note, in 2017, there was a child tax credit, but you had to make under $110,000 for married couples filing jointly to be eligible for it — not that possible in a high cost of living area.

But, returning to the math, even with the $2000 child tax credit, you’re looking at the following scenerio for a family of 4…

2017: $12.1k per married couple (standard deduction) + $16.2k personal deduction (family of 4) + $2k child tax credit (1k per child) = $30.3k of income not taxed

2018: $24k per married couple + $0 personal deduction + $4k child tax credit = $28k of income not taxed

$30.3k>$28k

As you see above, the reality is that while it’s not far off, if you have a family of 4, you’re actually paying more in tax in 2018 due to the standard deduction / personal exemption / child tax credit changes. The more kids you have, the more this will impact you.

To be clear, for the 2017 rules, if you were to take out the $2k of child tax credit for 2 kids (assuming you wouldn’t qualify due to income phase out), you’re going to end up with $28.3k not taxed in 2017 vs $24k (no kids) or $28k (2 kids) not taxed in 2018. So it’s a loss or wash at best.

So, Wait, Wasn’t the Standard Deduction DOUBLED?

Let’s summarize so far.

Standard deduction was almost doubled. From $6050 to $12k per person.

But.

The personal exemption was removed (worth $4050 in tax free money per person in the family)

And.

The child tax credit was changed so more people could get it (not just people in lower income brackets) and raised from $1k to $2k per child BUT not enough to replace the loss of the personal exemption per child.

Got it?

So How About Dem Tax Brackets?

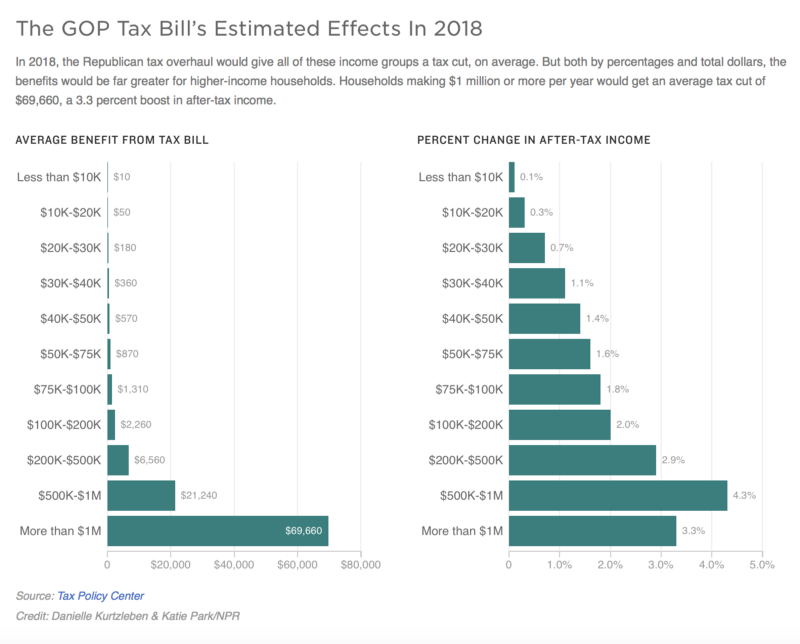

The new tax brackets that are in effect until 2025 do bring down general taxes for most filers. But, the decrease in taxes is wayyyy more substantial at the top end of the income spectrum. Here’s a pretty chart to explain this better than I can:

The Marriage Penalty — Still Alive and Kicking, But Barely…

I’ve been a proponent of getting rid of the marriage penalty (so much so that I ended up being interviewed on NPR about thisa few years ago) as the old tax system was set up to penalize families with two working parents, especially where both parents earn similar incomes.

How anyone thought this was fair or legal is beyond me, but it’s how the system was set up (there is still a marriage penalty built into the 2018 tax plan, but it’s not nearly as offensive as it was in prior years.)

You may have never heard of the marriage penalty, as you may be enjoying a marriage “bonus” (sorry that’s going away mostly in 2018 as well.)

The best way to understand the marriage penalty is…

In 2017, you could earn up to $418,401 as a single filer, and remain in the 35% tax bracket. OR, as a married couple, you could earn… $470,001 before being placed in the top 39.6% tax bracket. This didn’t just impact people earning $400k+. With the exeption of the lowest tax brackets, it was plain to see that the tax system incentivized one person in the married household to stay home. Because, the reverse math = a married person can earn up to $470,001 and if their partner made $0 in income, they would pay no more than 35% on their taxes as a married couple. But if they made that much single, every dollar over $418,401 would be taxed at 39.6%.

In case you’re wondering, you are not allowed to file “single” if you’re married, and the “married filing separately” tax brackets have an even worse marriage penalty built in. It’s a tax plan that makes sense maybe in the 1950s, but not today.

The one nice thing about the “going away in 2025” tax brackets is (not that they are going away in 2025) but that they mostly remove the marriage penalty. They make sense. The married filing jointly brackets are actually double the single brackets, all the way up to $400k in income. I still think the marriage penalty should be removed entirely, but one could argue if a couple is making $400k (even in the Bay Area) they are doing well for themselves and can pay more in taxes. In the new plan, you can make up to $500k as a single person and not reach the top tax bracket, or $600k as a married couple (so if you’re both earning $300k, it’s really best to not get married or get a divorce, financially speaking.)

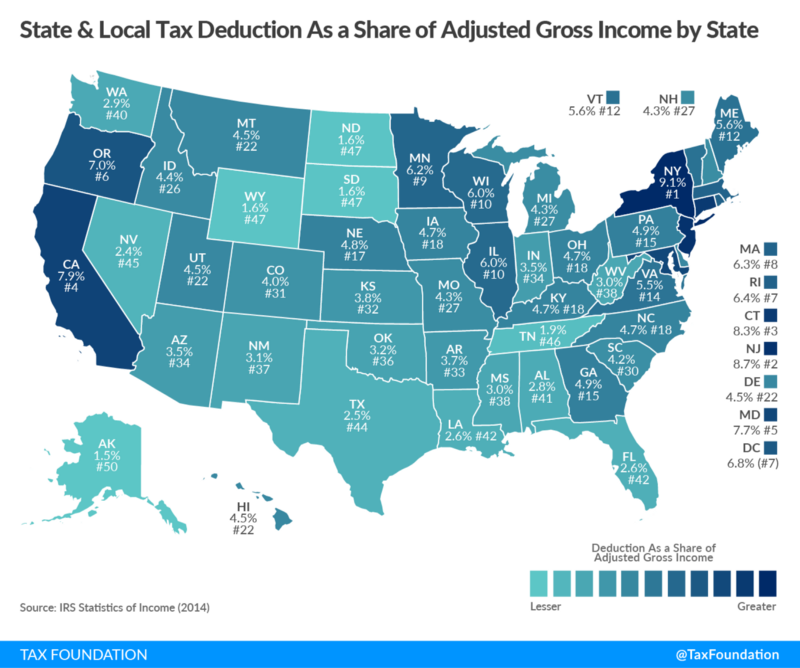

Where the marriage penalty sticks in 2018, other than the top tax brackets, is in the SALT deductions — which impact high-tax states the most.

Can someone explain to me why a single person can deduct $10k in state income tax and real estate tax, while a married couple can deduct $10k total? That’s a $10,000 loss of a deduction just because you are married.

I’m unsure why the tax plan, which seemed to try to remove most of the marriage tax penalty, was approved without realizing how this adds a NEW marriage tax penalty to the system.

About that SALT deduction (hold the pepper)

If you pay more than $10,000 as single OR as a married couple in income tax, state sales tax and real estate tax, then congrats, you’re the BIGGEST LOSER of the 2018 tax plan. You can collect your award by paying a whole lot more in taxes next April.

In summary, because it’s 1 O’Clock on a Saturday and I should be doing something other than explaining the 2018 tax plan to the 5 people who read my blog…

Most of the “good” stuff you’ve heard about the 2018 tax plan, unless you’re a very income earner/family, is not really that great. It’s not bad per se, and you may see your taxes come down a bit — but the biggest cuts and savings are going to wealthy people and especially to businesses. I’m not going to use this article to make a statement on why that’s good or bad, it just is what it is. Do not let Trump’s marketing team convince you otherwise.

And as for how the country will fare in this tax plan, we’ll leave that one for the economists…